Tax Day: What to know as filing deadline approaches for many Americans

PHOENIX - For 2024, Tax Day falls on April 15 for most Americans, according to IRS officials.

With a matter of days left before taxes will need to be filed, there are a number of advice IRS officials are offering for Americans who still need to get that annual task done.

Here's what to know.

How many Americans wait until the last minute to file taxes?

According to Intuit, 20% to 25% of all Americans wait until the last two weeks before the tax filing deadline to prepare their returns, citing IRS figures.

I need more time to file my taxes. What should I do?

Depending on your situation, the answer may differ, according to information provided by the IRS.

On their website, IRS officials say U.S. citizens and resident aliens who live and work outside of the U.S. and Puerto Rico get an automatic two-month extension, until June 15, to file their returns. Tax payments, however, will still need to be made on April 15, or interest will accrue.

Meanwhile, members of the military who are on duty outside of the United States and Puerto Rico also get an automatic two-month extension to file, and those who are serving in combat zones have up to 180 days after they leave their combat zone to file their tax returns and pay any taxes due.

IRS officials also say they can postpone certain tax deadlines for taxpayers in disaster areas.

Those who don't fall under any of the conditions listed above can file an extension form for free via IRS Free File.

How can I file my taxes?

There are many ways to file your taxes.

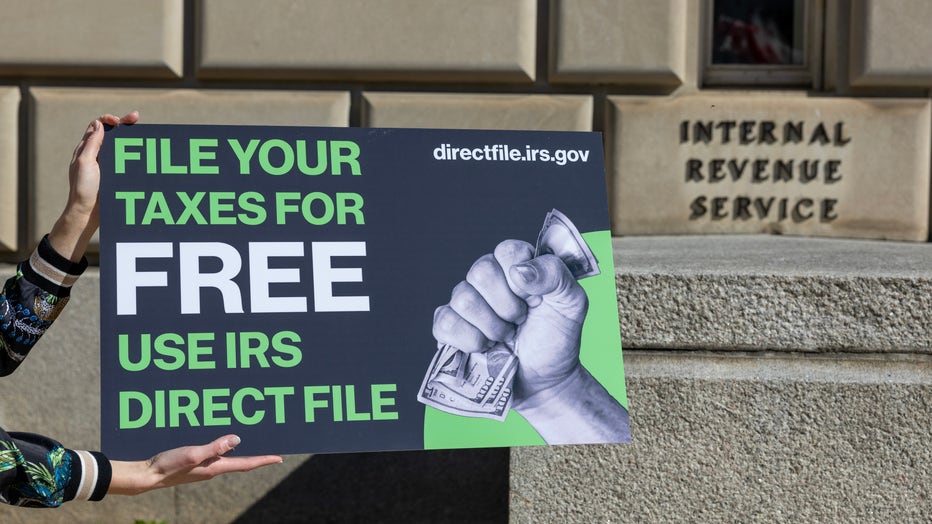

IRS Direct File

(Photo by Tasos Katopodis/Getty Images for Economic Security Project)

People who live in 12 states (Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington and Wyoming) and meet a number of criteria can use IRS Direct File to file their taxes for free.

The criteria are listed on the IRS Direct File website.

IRS Free File

Depending on your Adjusted Gross Income, you can use a free tax preparation software that is offered as part of IRS Free File. Each of the options, which are offered by what IRS officials call their trusted partners, have different maximum limits when it comes to AGIs, but the highest is $79,000. Some even offer free state tax filing.

Fillable forms are also offered for e-filing.

Tax help

Taxpayers who either make $64,000 or less, have a disability, or have limited English-speaking skills can get free basic tax return preparation as part of a program called Volunteer Income Tax Assistance (VITA).

Additionally, there is a specialized program called Tax Counseling for the Elderly (TCE) that specializes in questions about pensions and retirement-related issues that are unique to seniors.

Other options

There are a number of other options to file taxes, including tax professionals, tax preparation software, and mailing paper tax returns to the IRS.

Which way of tax filing is better?

According to the IRS, 90% of people e-file their tax returns. The agency notes that e-filing, when coupled with direct deposit, is the fastest way to get a refund, and they say e-filing meets strict security guidelines that help protect tax returns from identity theft refund fraud.

What about audits?

The Internal Revenue Service (IRS) building in Washington, D.C. (Andrew Harrer/Bloomberg via Getty Images)

Before all else, we must note that according to IRS officials, they notify people by mail if they are selected for an audit. They do not initiate an audit by telephone.

According to H&R Block, there are a number of things that could trigger an IRS audit, including:

- Reporting the wrong taxable income

- Making big donations with a small income

- Claiming the wrong deductions and credits

- Filing under a wrong status

To see if you are at risk of tax auditing, please consult a financial professional who is proficient on matters related to tax.

How often does the IRS audit?

According to a Congressional Research Service report that was last updated in November 2023, the audit rate differs depending on income, but ranges from 0.2% for those making $25,000 to $500,000, to 2.7% for those making more than $5 million.

The figures also show that those who claim Earned Income Tax Credit are "much more likely to face an audit than all but the highest income taxpayers," at 0.78%. The same report also noted that according to IRS Commissioner Danny Werfel, the agency's initial findings from an independent investigation support the conclusion that "Black taxpayers may be audited at higher rates than would be expected given their share of the population," even though the agency does not use race in its audit selection process. Werfel said there is a need for further research on the matter.

How much am I allowed to contribute to my 401(k) in a tax year?

According to the IRS, the limit for 401(k) contribution, as well as contributions to 403(b) plans, most 457 plans, and the federal government's Thrift Savings Plan, is $23,000.

What about IRAs and Roth IRAs? How much can I contribute to that in a tax year?

In 2024, the limit for annual IRA contributions is $7,000 for those under the age of 50, and $8,000 for those 50 and over, according to Fidelity. The limit is a combined limit for both traditional and Roth IRAs. Contributions more than earned household income are also not allowed.

For Roth IRAs, however, that same limit only applies to singles with a modified adjusted gross income (MAGI) of $146,000, and married couples filing joint returns with a MAGI of less than $230,000, total.

Above the MAGI limit, as listed above, people can make partial contributions, but those with a MAGI of over $161,000 (singles) and $240,000 (Married couples filing joint returns) will not be eligible for contributions.

"Calculating your MAGI and balancing contributions to multiple IRAs can be complicated, so consult a financial professional if you have any questions around your eligibility to contribute," Fidelity's website notes.

(This website does not provide financial or legal advice. The information provided above are meant to be informative, and nothing on this site should be considered as a substitute for professional financial/legal advice. Please reach out to a financial or legal professional for additional questions on legal or financial matters).