States with the highest energy bills: See how yours compares

What could Trump's energy policies look like?

Exxon Mobile CEO Darren Woods shared that the U.S. should stay in the Paris climate agreement under the incoming Trump administration. LiveNOW's Austin Westfall discusses what to expect from the new Trump administration on climate and environmental policy with Dr. Ian Palmer, who just released a book titled "How Oil and Gas Companies are Pivoting Toward Climate Change."

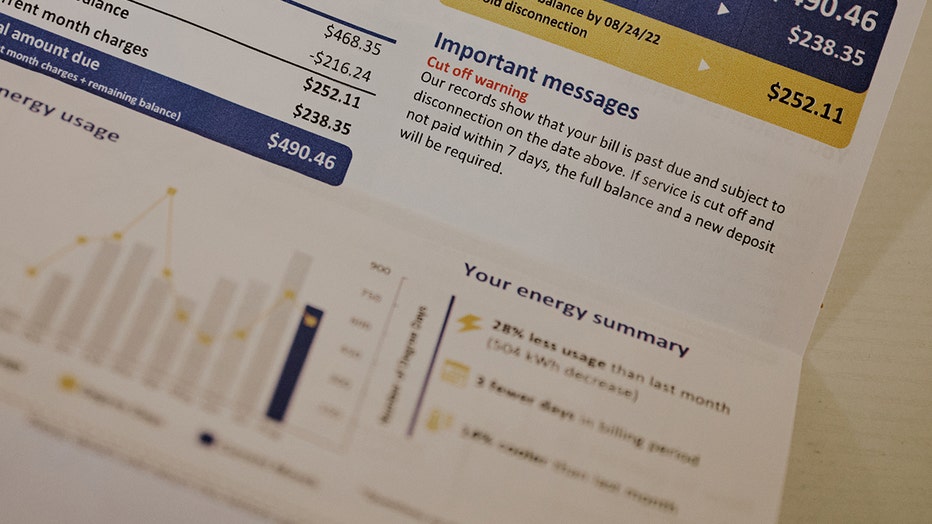

Americans are feeling the pinch this holiday season – and rising utility bills aren’t helping.

A new study by LendingTree revealed that electricity bills climbed to an average $185.59 in August – up 2.6% from August 2023, and in response, more than one in three Americans (34.3%), reported cutting back or skipping on essential expenses at least once in the past year to keep up with their payments.

Additionally, LendingTree also found that 23.4% have been unable to pay part or all of their energy bill during the same period. These figures were up slightly from a similar period in 2023, when 22% couldn’t pay their full energy bills.

Here’s a closer look at the impact this is having on households across the country.

Southern states cut back, skip payments on energy bills most

The study found that Southern states had the highest rate of residents who reported cutting back on or skipping necessary expenses to pay their energy bills.

Mississippi led, with 44.5% of residents reporting doing so. Other states, including Alabama (44.3%) and Oklahoma (42.1%) followed, with four of the top five states being in the South.

FILE: Electricity bill (Credit: William DeShazer for The Washington Post via Getty Images)

Mississippi residents were also the most likely to struggle to pay their energy bills, with 33.4% of residents reporting being unable to pay part or all of their energy bills over the past 12 months. This was followed by Connecticut (29.6%) and Alabama (29.4%).

"Southern states tend to be low-income states, which means that each month can be a struggle," Matt Schulz, a LendingTree chief credit analyst, explained. "Add in that these are also low credit score states, and the predicament gets tougher. Credit cards and other loans act as a de facto emergency fund for many Americans. That’s hardly ideal, but cards can give struggling Americans a lifeline when times are bleakest. However, if you have crummy credit, can’t get a credit card or a personal loan and are forced to rely on things like payday loans, your situation can become dire in a hurry."

Connecticut, Arizona residents have highest electricity bills

Connecticut had the highest average electricity bill, at $254.47, followed by Arizona ($252.60) and Texas ($233.38).

EARLIER: Energy costs: These are the states paying the most, least

The states with the lowest average bills in August 2024 were Washington ($100.56), Montana ($114.25) and Wyoming ($114.75).

As for where residents were most likely to keep their homes at unhealthy or unsafe temperatures, California (31.6%) ranked first. This was followed by Wyoming (30.5%) and Mississippi (29.1%).

Energy bill cost by state

Schulz said it appears that Americans’ situations are largely unchanged.

"Even though inflation has moderated in recent months, life is still crazy-expensive, and that can make it hard to pay your bills," he continued. "Lots of people have found themselves needing to make difficult decisions to keep the lights on. For some, that might mean cutting back on some expenses. For others, it might mean getting a side hustle or a second job. Tough times require tough financial decisions, and that’s what a lot of Americans are facing right now."

While the bills may be high in some states, LendingTree noted that it also comes down to usage: Some states may have high rates but low average monthly bills (and vice versa).

For example, Hawaii had the highest electricity rate at 42.10 cents per kilowatt-hour. That’s a whopping 210.1% higher than the national average of 16.63. Still, the average monthly energy bill in August 2024 in the state was $230.80 — only the fourth-highest in the U.S.

Despite having the biggest average bill, Connecticut only had the third-highest electricity rate at 29.93 cents per kilowatt-hour.

Conversely, Louisiana has the lowest electricity rate. However, its average bill is $190.70 — ranking 18th by average energy bill costs.