More Americans live paycheck to paycheck, report finds

7 ways to keep your finances strong amid the COVID-19 pandemic

Adjusting your budget and minimizing credit card debt are essential.

A larger proportion of Americans are living paycheck to paycheck, a report released Monday by LendingClub and PYMNTS found.

The percentage of U.S. consumers that lived paycheck to paycheck in December came in at 64%, according to the report. That figure equated to about 166 million and marked a 3% jump year-over-year.

In December 2021, 61% were living that way, the report said.

The report, conducted in collaboration with PYMNTS, polled over 3,900 consumers in the U.S. The surveys took place Dec. 8 to Dec. 23.

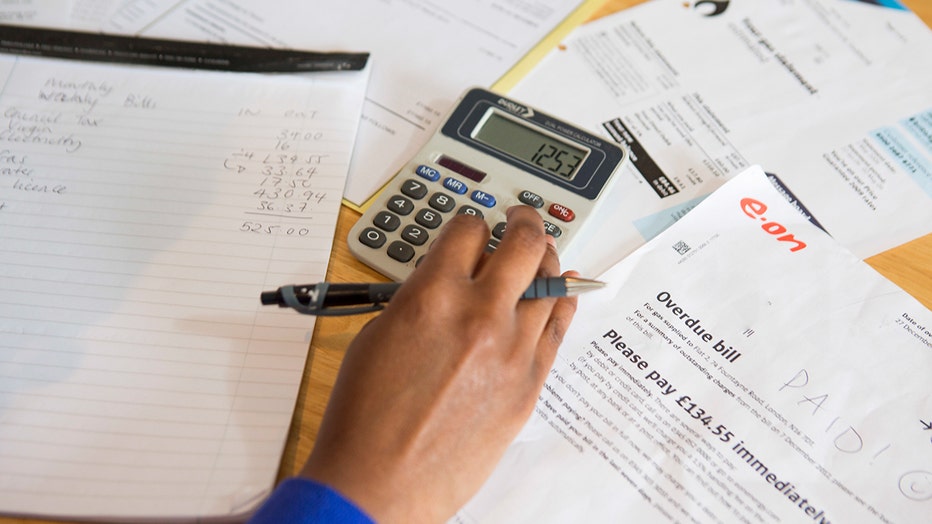

A young lady sits at her kitchen table at home checking over the household bills. Dealing with debt. Household utility bills making it difficult for a British home owner to afford. Difficulty paying gas and electricity bills is common as the economic

Many consumers making over $100,000 per year, 51%, indicated they were living paycheck to paycheck last month, compared to the 42% who said so at the same time the prior year, it also found. Of those, 16% reported difficulties covering monthly bills.

NEARLY 70% OF AMERICANS STRUGGLING TO PAY GROCERY BILLS, SURVEY FINDS

The report showed that for consumers making between $50-100,000, two-thirds lived paycheck to paycheck in December, and over three-quarters (78%) of those earning under $50,000 also said that.

Those percentages had "remained relatively constant" year-over-year, LendingClub Corporation said in a press release.

RELATED: New year's financial resolutions: Americans plan to take caution in 2023

Meanwhile, the report found about 40% of consumers living paycheck to paycheck expressed rosy outlooks about their financial situations. Just over a quarter, 27%, said they expected it "will worsen."

Inflation was pointed to as the "most worrisome factor" by roughly 75% of paycheck-to-paycheck consumers anticipating their personal finances will see some sort of decline this year, LendingClub Corporation said. Another popular reason was economic uncertainty.

INFLATION GAUGE CLOSELY WATCHED BY THE FED COOLED IN DECEMBER, BUT PRICES REMAIN HIGH

Inflation, while still painfully high, gave some indications of cooling in December, as previously reported by FOX Business.

The Consumer Price Index went down 0.1% month-over-month and rose 6.5% year-over-year, data released in mid-January by the Labor Department showed. The Personal Consumption Expenditures index, favored by the Federal Reserve for gauging inflation, increased 0.1% from November and 5% from the same time last year.