Bank of Mom and Dad paying out $1,474 a month on average to adult kids

Graphic created by FOX 5 Atlanta

ATLANTA - With economic pressures mounting, adulting has never felt more expensive—and more parents are stepping in to help. A new report from Savings.com shows that financial support from parents to their adult children has reached its highest level in three years, even as many parents begin to reconsider how long they can afford to keep giving.

More adult children needing help

What we know:

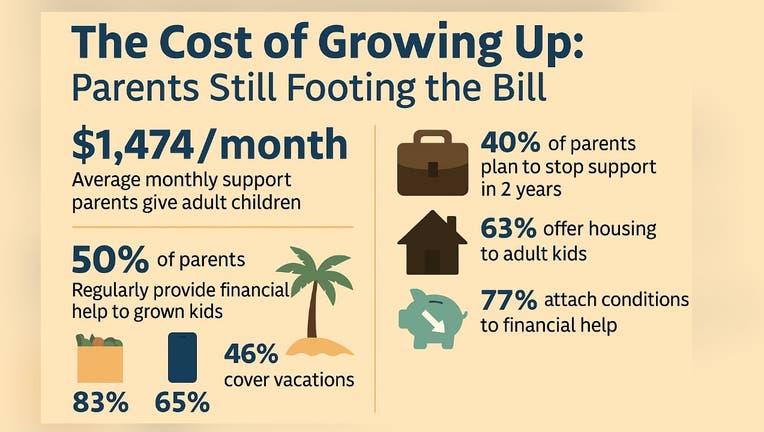

Half of parents with adult children in the U.S. are providing them with regular financial assistance, the report says. On average, parents are contributing $1,474 per month—a 6% increase from last year. That’s nearly $18,000 annually.

Key support areas include:

83% of parents help pay for groceries

65% assist with cell phone bills

46% contribute to vacation costs

Parents are also helping with larger expenses like tuition and housing. School-related costs are especially burdensome for those supporting Generation Z (ages 18–28), who receive nearly $1,200 monthly on tuition alone—double what parents were paying last year.

Parents of Millennials (ages 29–44) still contribute, though typically less. In contrast, Generation X (ages 45–60) seldom receives parental support, likely due to established careers or inherited wealth.

Gen Z needs most help

By the numbers:

Here's a closer look at the numbers.

$1,474/month: average financial support per adult child

$863/month: average for Millennials

$1,800/month: average for Gen Z

77% of parents attach conditions to their support

63% offer housing to adult children

51% of live-at-home adult children now contribute to household expenses (up from 39% in 2024)

40% of parents plan to cut financial support within two years

50%+ have sacrificed their own financial security to support their children

Factors behind increase

The backstory:

This trend gained momentum during the pandemic and has persisted as inflation and cost-of-living pressures remained high. Savings.com began tracking the "Bank of Mom and Dad" in 2022, and their latest report, based on a survey of 1,001 parents conducted in February 2024, reflects the highest level of parental support yet.

Though the U.S. economy has remained relatively strong, ongoing international trade tensions, policy shifts under a new presidential administration, and a growing generational wealth gap have kept many young adults financially tethered to their parents.

Future impact on parents

Why you should care:

This rising trend comes with real consequences—especially for parents nearing retirement. Nearly half of parents providing support admit it’s affecting their financial security, with many choosing to live frugally, tap into savings or retirement funds, delay retirement, or even take on debt to continue helping their adult children.

A significant number (40%) feel pressured to provide this assistance, even when it strains their resources. And while 53% still feel obligated to help, that number has declined from 61% last year, suggesting a slow shift in mindset.

Parents' expectations

What they're saying:

Parents’ generosity often comes with expectations. While 23% give money unconditionally, 77% now attach strings to their support, up from 71% last year. These conditions may include contributing to household expenses, working toward financial independence, or following certain rules. Only 19% say they’re willing to provide financial help indefinitely.

Parents planning to cut support

What's next:

With 40% of parents planning to cut support within two years, the future of the "Bank of Mom and Dad" may soon look different. The shift could encourage greater financial independence among younger adults—but it also raises concerns as economic uncertainty and the possibility of a recession loom.

If inflation continues or the job market tightens, the withdrawal of parental support may hit Gen Zers the hardest, especially those still in school or just entering the workforce.

How the survey was conducted

Dig deeper:

Here is information about how the survey was conducted by Savings.com.

Survey Methodology: Conducted in February 2024 by Savings.com

Sample: 1,001 U.S. parents of adult children (median age: 56, income: $50,000–$74,999)

Focus: Parents supporting adult children without disabilities

Gender split: 50% men, 50% women

The complete findings paint a clear picture: American parents are still going to great lengths to support their grown children, but many are starting to feel the pressure—and planning for a cutoff.